SEO for Financial Advisors: Fixing the Common Mistakes That Hurt Your Lead Generation

Many financial advisors work hard to grow their businesses, yet still struggle to get consistent leads online. You may already be posting on social media, updating your website, or reaching out to new clients, but if your SEO strategy has hidden gaps, your advisory practice may never reach the audience you deserve. It’s frustrating when your expertise doesn’t match your visibility, especially in a field where client relationships and trust matter more than anything else. That’s why understanding the most common SEO mistakes—and learning how to correct them—can be a game changer for your business.

At Masterly Tech Group, we support financial advisors with SEO strategies that actually attract clients instead of creating more work. Our team sees the same issues across the industry: outdated website structures, missing keywords, slow site performance, and content that doesn’t reflect the deep understanding financial professionals bring to the table. Combined with modern tools like a virtual assistant for financial advisors or financial virtual assistant support, you can transform how you manage marketing, client data, operational tasks, and digital outreach. Today’s SEO landscape demands more than just good intentions—it requires a plan built on proven systems.

Why SEO Matters More for Financial Advisors Than Ever

Financial advisors face unique challenges because potential clients often make life-changing decisions based on trust. Before someone works with you, they research your background, your services, and your expertise. That means your online presence is often their first impression. If your website doesn’t reflect your professionalism, you risk losing new business before the conversation even begins.

Poor SEO also affects how well your advisory practice stands out among competitors. With strong optimization, even a solo advisor can compete with major firms. But without it, even highly qualified advisors may get overshadowed online. That’s why many financial advisors also hire virtual assistants or use assistant services for financial operations to handle time consuming marketing responsibilities. Delegating tasks like posting social media updates or managing client communication helps you stay visible without sacrificing your core work.

Understanding the SEO Landscape for Financial Professionals

SEO has changed dramatically over the past years, and financial planners now need strategies that reflect how clients search for investment opportunities, financial planning assistance, and long-term support. Prospects look for credibility, a transparent onboarding process, and clear communication. If your content doesn’t address those needs or isn’t optimized for search engines, your website may never reach the right audience.

The mix of financial software, portfolio accounting software, and data analysis tools used by financial advisors requires tailored SEO to speak to client pain points effectively. Many advisors also rely on virtual assistants or financial advisor virtual assistant teams to manage client files, administrative tasks, reports, and scheduling appointments. This frees your attention so you can focus on client interactions rather than operational tasks that drain time.

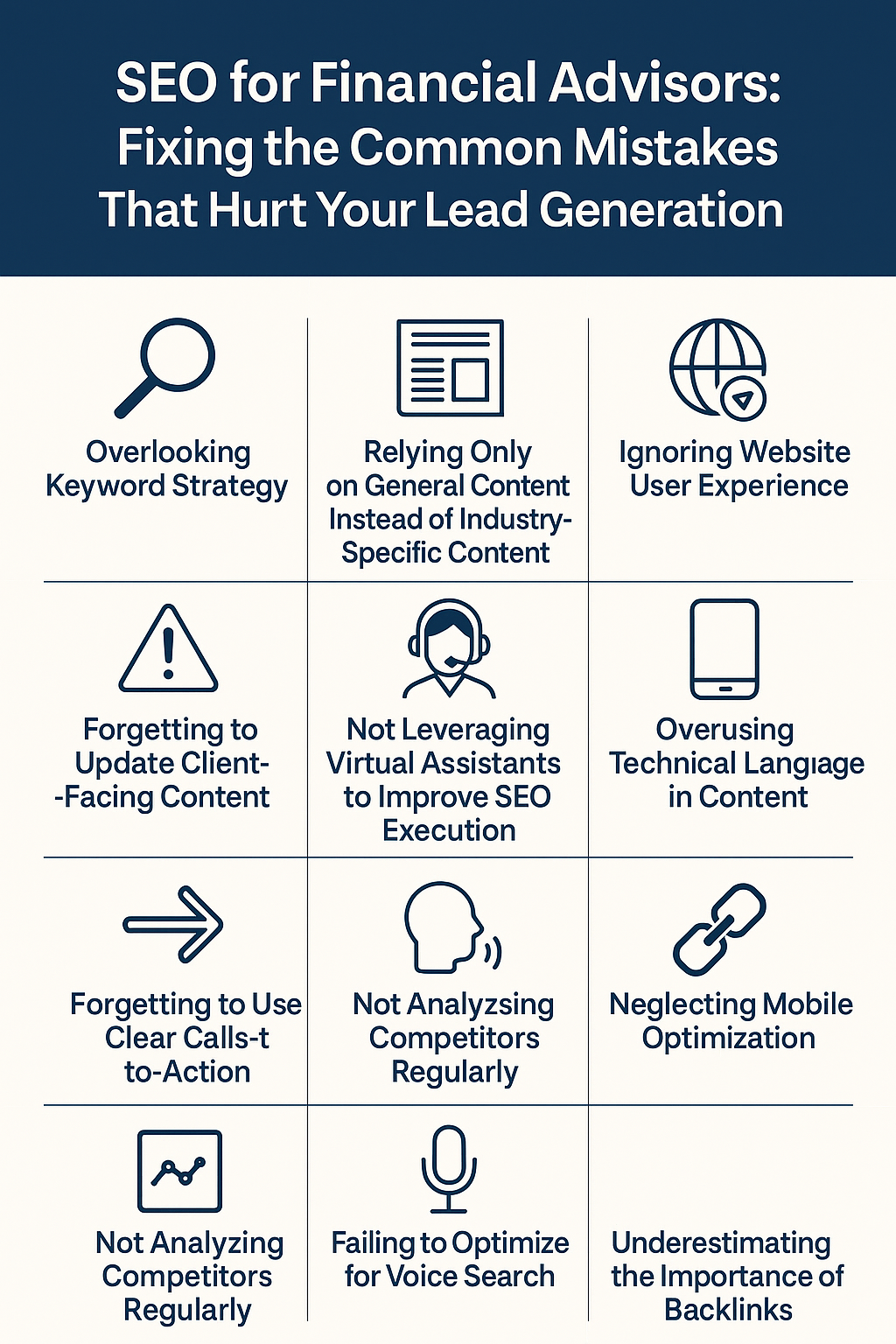

Overlooking Keyword Strategy

Many financial advisors underestimate the importance of keywords. Without the right keywords, your website becomes invisible to people searching for services for financial advisors. Advisors often use technical wording that clients don’t understand, or they skip essential terms that make content rankable. When keywords are missing, search engines simply cannot match your website to what new clients are Googling.

A well-structured keyword plan should reflect the services your advisory practice offers, such as financial planning, preparing reports, handling client agreements, or administrative support. You can also improve performance by having a dedicated assistant or virtual assistants review competitor terms, market research, and content gaps. Advisors who hire virtual assistants often see dramatic improvements in online reach because they no longer overlook these specialized tasks.

Relying Only on General Content Instead of Industry-Specific Content

Another major mistake is producing content that’s too broad. Financial advisors must demonstrate extensive knowledge and a deep understanding of client concerns. When your content is generic, prospects may not feel confident enough to reach out. Clear, helpful articles help support financial advisors by building trust through expertise.

Virtual assistant companies can help financial advisors write blog posts, edit client communication, and prepare reports that reflect your experience. High-value content positions you as an industry expert. With virtual assistant services, you can publish consistent material that answers questions new clients often ask about wealth management, insurance, tax planning, or financial planning strategies.

Ignoring Website User Experience

A slow or outdated website is one of the worst SEO mistakes. If your website frustrates new clients before they even learn about your services, you lose valuable opportunities. Search engines prioritize user experience—fast load times, mobile-friendly layouts, and easy navigation are essential. Advisors must manage these elements well if they want to compete.

When you hire a virtual assistant or financial advisor virtual assistant, they can support improvements to your website by checking broken links, updating pages, managing client onboarding forms, organizing client files, and ensuring content is easy to read. Small improvements create major benefits, especially when attracting new business.

Not Optimizing for Local Search

Financial advisors often depend on local visibility. Whether you’re building new business in your community or expanding into nearby markets, local SEO determines who discovers you. If your site doesn’t include local terms or location-based keywords, search engines may not display your services to nearby prospects.

Virtual assistants can support financial advisors by updating local listings, improving client communication for follow ups, managing scheduling meetings across time zones, and posting consistent social media posts. These operational tasks enhance local visibility and boost credibility across digital platforms.

Forgetting to Update Client-Facing Content

Many financial advisors create a website and then forget to update it. Outdated information harms your credibility and your SEO ranking. Search engines reward fresh content because it indicates your business is active and relevant.

Virtual assistant services help maintain a regular update schedule. A financial virtual assistant or dedicated assistant can revise articles, improve email marketing materials, manage data entry, and ensure your site reflects current financial opportunities. When client data changes or regulations shift, updating content promptly helps demonstrate professionalism.

Not Leveraging Virtual Assistants to Improve SEO Execution

One of the biggest mistakes financial advisors make is trying to do everything themselves. Tasks like managing marketing campaigns, reviewing analytics, posting social media content, drafting financial reports, and updating client communication often fall behind. These time consuming responsibilities pull attention away from clients.

Virtual assistants help financial advisors delegate tasks more efficiently. When you hire virtual assistants, you gain support that extends beyond administrative tasks. Virtual assistant companies often offer virtual assistant services designed specifically for financial professionals, including:

- Data entry and expense tracking

- Preparing reports and financial reports

- Managing client agreements and client files

- Supporting onboarding process steps

- Drafting content for services for financial advisors

With help from knowledge workers who understand the industry, your SEO becomes consistent, efficient, and effective.

Overusing Technical Language in Content

Financial advisors are experts, but your clients may not understand the language you use every day. When website content is too complex, prospects disengage. The goal of SEO is not just to attract new clients, but to make sure your message resonates with them.

Virtual assistants well versed in digital communication help rewrite content in an accessible way. They offer virtual assistant services that clarify concepts, rewrite explanations, improve readability, and support financial advisors through clear communication that builds trust.

Neglecting Mobile Optimization

More clients than ever browse financial services on mobile devices. If your website appears broken or difficult to navigate on a phone, you risk losing business. Search engines now rank mobile-friendly sites higher, which means mobile optimization is non-negotiable.

Hiring a virtual assistant or a financial advisor virtual assistant helps ensure your pages perform well across devices. They can report issues, manage updates, and test new designs before they go live.

Forgetting to Use Clear Calls-to-Action

Some financial advisors forget to guide website visitors toward taking action. Without clear CTAs, potential clients may not know how to book meetings, complete client onboarding, or request more information. SEO brings people to your site, but a strong CTA turns them into new clients.

Virtual assistants help financial advisors create compelling calls-to-action based on business needs. These might include links to schedule a consultation, onboarding forms, downloadable checklists, or contact options.

Not Analyzing Competitors Regularly

The financial services market changes constantly. When advisors don’t review competitor websites, they miss opportunities to improve. Virtual assistants with market research skills can monitor industry trends, analyze content strategies, and compare services for financial advisors across platforms.

A financial virtual assistant can highlight where you’re falling behind, whether in client communication, marketing outreach, or specialized tasks like preparing reports and updating financial software documentation.

Failing to Optimize for Voice Search

With more people using voice-activated devices, voice search optimization is essential. Clients often ask natural questions, such as:

- “How do I hire a financial advisor?”

- “What does a financial planner do?”

- “What’s the best investment opportunity near me?”

When your content reflects natural phrasing, you increase your chances of appearing in voice search results. A virtual assistant for financial advisors can rewrite content to match conversational patterns.

Underestimating the Importance of Backlinks

Backlinks—links from reputable websites back to yours—boost your authority. Financial advisors often overlook this because they’re busy serving clients. Without backlinks, even a beautifully optimized website may struggle to gain traction.

Virtual assistants can help with outreach, writing guest posts, and maintaining relationships with industry experts who may promote your content. This helps build authority and credibility online.

Not Using Analytics to Improve SEO Results

Many advisors ignore analytics because the dashboards feel overwhelming. Yet data shows what is working and what needs improvement. With analytics, you can track:

- Client interactions

- Engagement trends

- Popular pages

- Drop-off points

Virtual assistant companies can analyze this information for you. A financial advisor virtual assistant or highly qualified assistant can interpret the data and suggest ways to refine your strategy.

Ignoring Administrative Tasks that Affect SEO

Administrative tasks may not sound like part of SEO, but they matter more than you think. Missing emails, delayed follow ups, and unorganized client files create gaps in client communication. These gaps harm your online reputation, which directly affects SEO.

A virtual assistant for financial advisors can manage administrative work, scheduling appointments, phone calls, and operational tasks that influence how prospects perceive your business. Strong internal organization leads to stronger external branding.

Overlooking Social Media as an SEO Tool

Social media posts do not directly change SEO rankings, but they significantly increase visibility. When your content is shared, referenced, or clicked, search engines notice the increased traffic.

Virtual assistants can handle scheduling meetings, preparing social media posts, data entry for campaigns, and managing follow ups with prospects who engage with your content online.

Trying to Do Everything In-House

Financial advisors often assume hiring an in house assistant or a full time employee will solve their marketing and SEO problems. But in many cases, an in house staff member cannot match the flexibility, hourly rate advantages, or comprehensive suite of skills provided by virtual assistants.

When you hire a virtual assistant, you can scale support based on your business needs. Instead of managing a new employee or monitoring time zones, you can focus on clients while assistants handle specific tasks that support growth.

Missing Opportunities to Improve Client Experience

SEO is not just about ranking—it’s about creating an exceptional client journey. From client onboarding to client agreements, every touchpoint shapes how prospects feel about your advisory practice.

Virtual assistants support financial advisors by organizing onboarding steps, updating client files, preparing reports, and monitoring email marketing engagement. Better experiences lead to better reviews, which strengthens SEO.

Not Incorporating Video Content Into SEO Strategy

Video content builds connection quickly. Many financial advisors avoid video because it feels uncomfortable, but video dramatically boosts engagement and improves search rankings.

A financial virtual assistant or dedicated assistant can help you script, edit, and publish videos consistently. Videos also enhance client relationships by humanizing your business.

Overlooking the Power of Long-Form Educational Content

Financial professionals often underestimate how deeply clients research before choosing an advisor. High-quality long-form content showcases your expertise and uses financial planning insights to demonstrate your value.

Virtual assistants can draft long-form pieces, revise existing systems content, and structure educational resources that address investment opportunities or financial reports.

Not Creating Content That Reflects Client Questions

The best SEO strategies answer actual client questions. For example, advisors frequently receive questions about taxes, investments, saving strategies, or market volatility. Creating content around these topics improves SEO and helps manage client communication.

Virtual assistants help gather common questions from follow ups or phone calls and turn them into valuable content.

Missing Internal Linking Opportunities

Internal links help search engines understand your website structure. Many financial advisors skip internal linking altogether, weakening their SEO.

Virtual assistants well versed in SEO strategy can manage internal linking by connecting articles, reports, and services for financial advisors into a cohesive web of information.

Not Updating Technical SEO Elements

Technical SEO includes alt text, page titles, schema markup, and metadata. Without these essential elements, even the best content may never rank.

Virtual assistants can manage updates to improve indexability, speed, and overall performance.

Allowing Client Communications to Become Disorganized

SEO depends on reputation, and reputation depends on communication. Missed emails, delayed responses, or poor follow ups impact reviews and search visibility.

A financial advisor virtual assistant helps you manage communication through:

- Email marketing

- Scheduling appointments

- Handling client files and agreements

This results in stronger relationships and more referrals.

Spending Too Much Time on Administrative Work Instead of SEO

When advisors are overwhelmed with operational tasks, they rarely have time for marketing. Delegating these tasks to virtual assistants frees you to focus on your business and client relationships.

Assistants can handle:

- Administrative support

- Data entry

- Expense tracking

- Specialized tasks related to financial software

This creates space for strategic planning.

Failing to Personalize Website Content

Personalized content resonates more than generic messages. Advisors who tailor their content to specific audiences attract more qualified leads.

Virtual assistants support financial advisors by preparing personalized outreach messages, revising web pages, and refreshing service descriptions that connect with your ideal clients.

Overlooking Client Testimonials and Reviews

Reviews influence SEO and credibility. Many advisors forget to collect testimonials, even though satisfied clients are willing to share their experiences.

Virtual assistants can manage the review-gathering process and maintain client communication regarding feedback.

awsNot Building a Scalable SEO Workflow

Financial advisors need systems that grow with the business. SEO cannot be random or inconsistent. A structured plan supported by virtual assistants ensures continuous improvement.

A scalable workflow includes:

- Regular content updates

- Client onboarding support

- Analytical reviews

- Social media presence

- Follow ups with prospects

This supports long-term success.

Why SEO Success Requires Delegation

SEO is powerful, but it requires time, attention, and consistency. When financial advisors try to manage everything alone, growth becomes limited. Delegation is essential—especially in a digital world where content must be updated constantly.

Virtual assistants give advisors the flexibility to manage, update, and implement strategies without hiring costly in house staff or a full time employee.

How Masterly Tech Group Helps Financial Advisors Grow

At Masterly Tech Group, our team helps financial advisors eliminate these common SEO mistakes while also offering virtual assistant services tailored to the industry. From client communication to data entry, content writing, and social media management, our virtual assistants help you manage the tasks that support your business growth.

Whether you need help preparing reports, reviewing client files, updating your website, or creating marketing materials, we provide a dedicated assistant with extensive knowledge of financial operations.

Humanized Final Thoughts

Growing an advisory practice takes more than technical skill—it requires being visible to the people who need your guidance. Every financial advisor has a story, a mission, and a commitment to serving clients, but without strong SEO, many prospects may never discover your expertise. Taking steps to improve your visibility today can help build a future where your advisory practice thrives, your content resonates, and your digital presence reflects the value you provide. You don’t have to fix every SEO issue alone. With the right support, your online presence can become one of your strongest tools for growth.

Speak With Our Team About Virtual Assistant Support for Financial Advisors

If you’re a financial advisor looking to strengthen your SEO and eliminate the operational challenges that slow growth, our team at Masterly Tech Group is here to help. We offer virtual assistant services designed to support financial advisors with marketing, client communication, administrative tasks, and specialized tasks that free your time and increase productivity. Whether you’re a solo advisor or leading a growing team, our virtual assistants can help you stay organized, consistent, and visible.

Contact us at (888) 209-4055 to book a free consultation, and let us walk you through how a virtual assistant for financial advisors can streamline your workflow, elevate your online presence, and help you attract more clients with confidence.