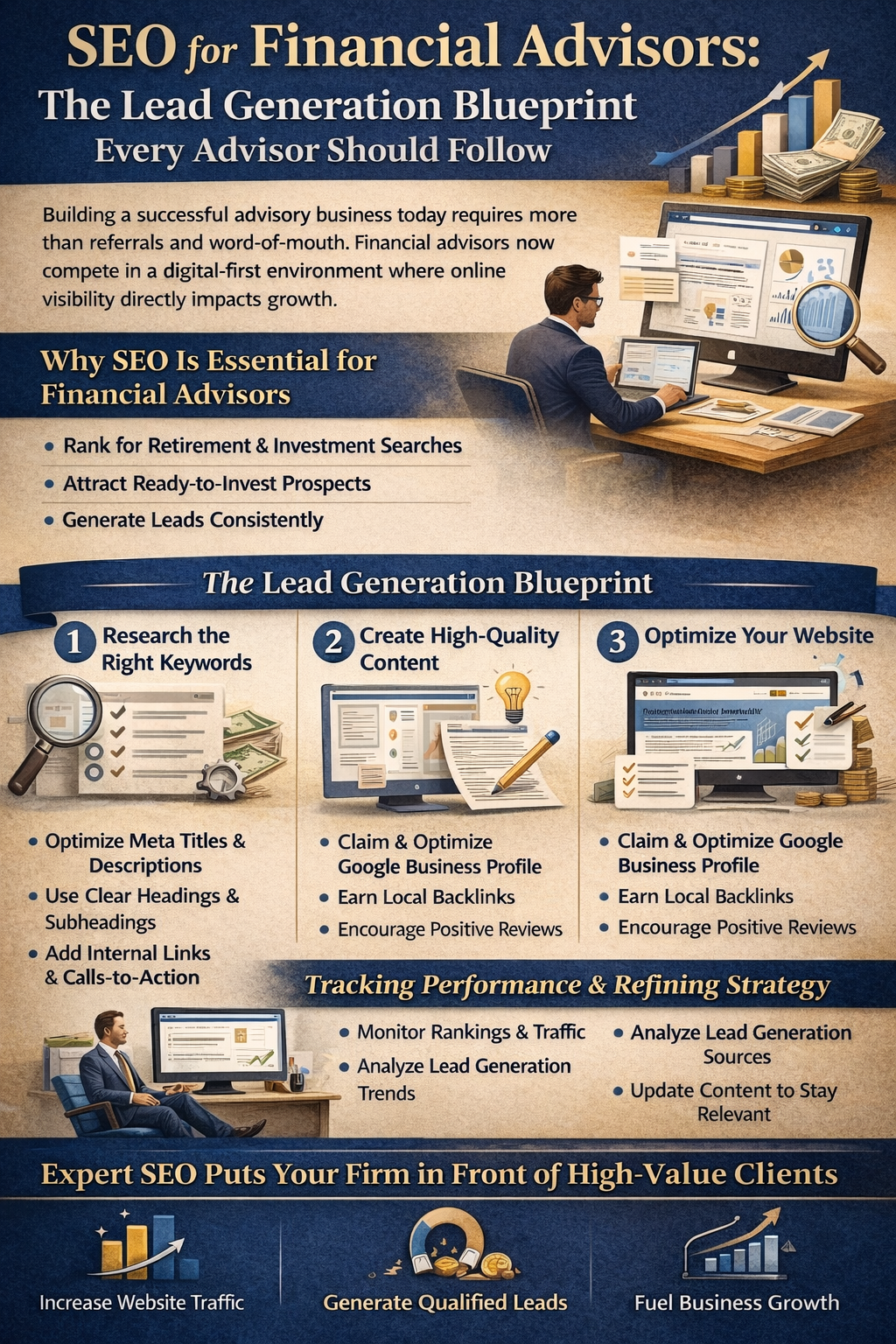

SEO for Financial Advisors The Lead Generation Blueprint Every Advisor Should Follow

Building a successful advisory business today requires more than referrals and word-of-mouth. Financial advisors now compete in a digital-first environment where online visibility directly impacts growth. SEO is no longer optional for advisors who want consistent lead generation and long-term stability. When done correctly, SEO positions advisors in front of retirement-focused and investment-ready clients at the exact moment they are searching for guidance.

Why SEO Has Become a Core Growth Channel for Advisors

Search engines are often the first stop for individuals planning their financial future. Potential clients search for answers before they ever speak with an advisor. A strong SEO strategy ensures your firm appears during those high-intent moments. This visibility builds trust long before the first consultation.

Understanding How Prospective Clients Search Online

Most clients do not search for firms by name. They search for solutions, strategies, and reassurance. Financial advisors who understand search intent can align content with real client concerns. SEO bridges the gap between curiosity and conversion.

SEO Is Not Just About Rankings

High rankings alone do not generate results. SEO must support lead generation, client relationships, and long-term business goals. A well-optimized site guides visitors toward action while reinforcing credibility. Every page should serve both users and search engines.

The Foundation of SEO for Financial Advisors

A strong SEO foundation starts with technical structure. This includes site speed, mobile optimization, and secure browsing. Search engines favor websites that offer smooth user experiences. Technical gaps can limit visibility even with great content.

Keyword Strategy That Reflects Client Intent

Keywords must reflect how real clients think and search. Retirement planning, investment strategies, and financial planning topics should be prioritized. Each page should focus on a clear theme without keyword stuffing. Strategic placement improves relevance and readability.

Creating Content That Builds Trust and Authority

Content is the backbone of SEO for financial advisors. Educational articles demonstrate expertise without giving advice. Clear explanations help potential clients feel informed and confident. Over time, consistent content builds authority with both users and search engines.

Blogging With Purpose, Not Just Volume

Blogging works best when content answers common client questions. Articles should address retirement planning, investment opportunities, and life transitions. Each post should have a clear takeaway and next step. Quality always outperforms quantity.

Local SEO for Advisors Serving Specific Regions

Local SEO ensures visibility within your service area. Optimized profiles and localized content help attract nearby clients. This strategy is especially effective for solo advisor practices and growing firms. Local search results often convert faster than national traffic.

On-Page SEO That Converts Visitors Into Leads

On-page SEO includes titles, headings, internal links, and calls to action. These elements guide users through the site. Clear structure helps visitors find answers quickly. Search engines reward pages that keep users engaged.

Website Structure That Supports Growth

A well-organized website improves both SEO and usability. Pages should flow logically and support client journeys. Clear navigation reduces bounce rates and improves rankings. Structure plays a larger role than many advisors realize.

Lead Generation Starts With Clear Messaging

Visitors should immediately understand who you help and how. Messaging should focus on outcomes, not credentials alone. Clear value propositions increase conversions. SEO brings traffic, but messaging turns traffic into clients.

Why SEO and Virtual Assistants Work Together

SEO success requires consistency, time, and execution. Virtual assistants help maintain that consistency behind the scenes. They support ongoing optimization, content publishing, and operational follow-through. This combination allows advisors to focus on strategy and client relationships.

The Growing Role of Virtual Assistants in Advisory Firms

Virtual assistants are now essential knowledge workers within advisory practices. They handle recurring tasks that slow down growth. This support structure enables scalability without expanding in house staff. Advisors gain flexibility without sacrificing quality.

How Virtual Assistant Services Support SEO Efforts

Virtual assistant services assist with publishing content, updating pages, and monitoring performance. They manage tasks that are time consuming but critical. This support ensures SEO initiatives stay active and aligned. Consistency is what drives long-term results.

Financial Advisor Virtual Assistant Support Explained

A financial advisor virtual assistant understands compliance-driven environments. They assist with administrative work while respecting confidentiality. This allows advisors to delegate tasks without risk. Proper delegation improves efficiency and focus.

Dedicated Virtual Assistants for Ongoing Execution

Dedicated virtual assistants provide continuity and familiarity with your business. They learn your workflows, systems, and preferences. This reduces errors and improves turnaround time. Over time, they become an extension of your team.

Managing Administrative Tasks Without Losing Momentum

Administrative tasks often interrupt high-value activities. Virtual assistants manage scheduling meetings, data entry, and preparing reports. This frees advisors to focus on clients and strategy. Productivity increases without burnout.

Client Communication and Follow Ups at Scale

Client communication requires consistency and timeliness. Virtual assistants manage follow ups, scheduling appointments, and routine phone calls. This ensures no opportunity falls through the cracks. Strong communication supports long-term client relationships.

Supporting Client Onboarding Efficiently

Client onboarding sets the tone for the entire relationship. Virtual assistants help manage the onboarding process smoothly. They organize client files, collect documentation, and coordinate next steps. This creates a polished and professional experience.

SEO Content Publishing Without Overload

Publishing SEO content consistently is challenging. Virtual assistants upload posts, format pages, and manage internal links. This removes bottlenecks from the content process. Advisors stay visible without added stress.

Managing Social Media Posts to Support SEO

Social media posts amplify SEO content reach. Virtual assistants schedule and manage these posts across platforms. This drives traffic back to optimized pages. Visibility improves without additional advisor effort.

Data Management and Client Data Accuracy

Accurate client data supports both marketing and service delivery. Virtual assistants maintain client data within existing systems. This reduces errors and improves reporting. Clean data supports better decision-making.

Handling Reports and Financial Documentation

Virtual assistants assist with preparing reports and organizing financial reports. They work alongside portfolio accounting software and financial software. This support improves turnaround times. Advisors maintain control without doing everything themselves.

Data Analysis Support Without Hiring Internally

Basic data analysis helps refine marketing and SEO strategies. Virtual assistants compile reports and track performance. This insight informs future decisions. Advisors gain clarity without hiring analysts.

Expense Tracking and Operational Oversight

Expense tracking is essential for business health. Virtual assistants manage records and flag trends. This supports smarter financial planning. Advisors stay informed without daily involvement.

Managing Existing Systems More Effectively

Virtual assistants adapt to existing systems rather than disrupting them. They work within established workflows. This ensures continuity and reduces onboarding friction. Efficiency improves without restructuring.

Specialized Tasks That Free Advisor Time

Virtual assistants handle specialized tasks that require focus but not advisor oversight. This includes market research and handling client agreements. Delegating these tasks increases productivity. Advisors reclaim valuable hours each week.

Supporting Advisory Practice Growth

A growing advisory practice needs scalable support. Virtual assistants support financial advisors as demand increases. This flexibility prevents overhiring. Growth becomes manageable and sustainable.

Supporting Solo Advisor Operations

A solo advisor benefits greatly from virtual support. Virtual assistants act as a dedicated assistant without the cost of a new employee. This levels the playing field with larger firms. Solo advisors gain leverage.

In House Assistant vs Virtual Support

An in house assistant comes with overhead and long-term commitments. Virtual assistant companies offer flexibility and scalability. Advisors can hire virtual assistants based on business needs. This approach reduces risk while maintaining support.

Hiring Virtual Assistants the Smart Way

Hiring virtual assistants requires clarity and planning. Advisors should identify specific tasks before onboarding. This ensures efficiency from day one. A structured approach leads to better results.

Understanding Hourly Rate and Cost Efficiency

Virtual assistants often operate on a predictable hourly rate. This allows better budgeting and cost control. Advisors pay only for productive time. This efficiency supports profitability.

Time Zones and Extended Coverage

Virtual assistants working across time zones extend operational hours. Tasks continue outside traditional business hours. This improves responsiveness and turnaround time. Advisors gain flexibility without overworking.

Virtual Assistants as a Game Changer

Many advisors describe virtual assistants as a game changer. They unlock growth without overwhelming workloads. This support transforms how advisory businesses operate. Efficiency becomes the norm.

Supporting Employees Without Expanding Headcount

Virtual support reduces pressure on existing employees. Teams remain focused on high-value work. Advisors avoid burnout and turnover. Support scales without expanding payroll.

Aligning SEO Strategy With Business Focus

SEO should align with long-term business focus. Virtual assistants help maintain that alignment. They ensure tasks are completed consistently. Advisors stay strategic while execution continues.

Lead Generation Through Consistent SEO Execution

Lead generation depends on sustained effort. SEO requires regular updates, monitoring, and refinement. Virtual assistants keep momentum going. This consistency drives results over time.

Managing Tasks That Drive Results

SEO involves many interconnected tasks. Virtual assistants manage these tasks efficiently. Advisors oversee strategy while execution runs smoothly. Results improve without micromanagement.

Building a Team That Supports Growth

A strong team includes both advisors and support roles. Virtual assistants become part of that team. Collaboration improves efficiency and outcomes. Growth feels controlled and intentional.

Services for Financial Advisors That Scale

Modern services for financial advisors must be scalable. Assistant services for financial operations support that scalability. Advisors gain flexibility as business evolves. Support adapts to demand.

Assistant Services for Financial Operations

Assistant services for financial tasks streamline daily operations. Virtual assistants manage operational tasks consistently. This reliability improves client experiences. Advisors maintain oversight without overload.

Supporting Financial Planners With Structure

Financial planners benefit from structured support. Virtual assistants maintain schedules, documentation, and communication. This structure enhances service delivery. Clients experience professionalism at every touchpoint.

Hiring Support That Matches Business Needs

Every advisory business has unique business needs. Virtual assistants can be tailored to those needs. This customization ensures efficiency. Advisors avoid one-size-fits-all solutions.

Long-Term Benefits of Delegation

Learning to delegate tasks is a critical growth skill. Virtual assistants enable smart delegation. Advisors regain time and mental bandwidth. Growth becomes sustainable.

From SEO Traffic to Trusted Clients

SEO attracts visitors, but service converts them. Virtual assistants support every step of the journey. From first visit to onboarding, systems work together. Trust builds through consistency.

How Masterly Tech Group Supports Advisor Growth

Masterly Tech Group helps advisors align SEO strategy with operational support. We understand how digital visibility and backend execution work together. Our approach focuses on efficiency, growth, and scalability. Advisors gain support without complexity.

How a Financial Virtual Assistant Strengthens Advisor Operations

A financial virtual assistant plays a critical role in helping advisory firms operate efficiently without expanding internal headcount. By handling recurring operational and client-facing tasks, advisors gain more time to focus on strategy and relationship building. This type of support is especially valuable in fast-growing practices where consistency and accuracy matter. The result is smoother workflows and improved service delivery.

Why Financial Professionals Are Adopting Virtual Support Models

Financial professionals face increasing demands from clients, compliance requirements, and business growth. Virtual support allows firms to remain agile while maintaining high service standards. By outsourcing non-revenue tasks, professionals reduce burnout and improve productivity. This shift supports sustainable growth without sacrificing quality.

Firms That Offer Virtual Assistant Services Gain a Competitive Edge

Advisory firms that offer virtual assistant services internally or through partners can scale faster than competitors. These services allow advisors to maintain responsiveness as workloads increase. Clients benefit from better communication and faster turnaround times. This operational advantage directly supports long-term growth.

Administrative Support That Removes Daily Bottlenecks

Administrative support is often the most overlooked need in advisory practices. Managing calendars, documents, and routine correspondence consumes valuable advisor time. Delegating these responsibilities improves focus and efficiency. Consistent support keeps operations moving without disruption.

Extensive Knowledge That Supports Complex Advisory Workflows

Virtual teams with extensive knowledge of financial operations understand industry-specific processes. This familiarity reduces training time and improves accuracy. Advisors benefit from support that integrates seamlessly into existing workflows. Experience matters when handling sensitive financial work.

A Comprehensive Suite of Services for Growing Advisory Firms

A comprehensive suite of virtual support services allows advisors to centralize operations. From administrative work to marketing support, everything operates under one structure. This reduces fragmentation and improves accountability. Advisors gain clarity and control as their business scales.

When It Makes Sense to Hire a Virtual Assistant

Many advisors reach a point where growth slows due to capacity limits. This is often the ideal time to hire a virtual assistant. Rather than adding overhead, virtual support provides flexibility. Advisors regain time without long-term staffing commitments.

Building a Deep Understanding of Your Advisory Business

The most effective virtual support comes from teams that develop a deep understanding of your business. Over time, assistants learn workflows, preferences, and client expectations. This familiarity improves efficiency and reduces errors. Support becomes proactive rather than reactive.

Supporting Growth While Serving More New Clients

As firms attract new clients, operational demands increase quickly. Virtual support ensures onboarding and communication remain consistent. Advisors can grow without compromising service quality. This balance is essential for reputation and retention.

Built and Managed by Industry Experts

Working with providers led by industry experts ensures higher standards of service. These experts understand advisor challenges and compliance environments. Their insight shapes better support systems. Advisors benefit from proven operational strategies.

Email Marketing Support That Nurtures Client Relationships

Email marketing remains one of the most effective tools for advisor communication. Virtual assistants help manage campaigns, follow-ups, and scheduling. This ensures consistent messaging without overwhelming internal teams. Strong communication builds trust over time.

Highly Qualified Virtual Assistants You Can Rely On

Highly qualified virtual assistants bring professionalism and accountability to daily operations. Their training and experience reduce risk and improve outcomes. Advisors gain confidence knowing tasks are handled correctly. Quality support directly impacts client satisfaction.

Well Versed Support Teams Adapt to Advisor Needs

Well versed virtual teams understand financial terminology and workflows. This reduces miscommunication and improves efficiency. Advisors spend less time explaining tasks. Support becomes seamless and dependable.

Support Solutions Built Around Your Specific Needs

Every advisory firm has specific needs based on size, services, and goals. Virtual support should never be one-size-fits-all. Customization ensures the right level of assistance at every stage. This flexibility supports long-term success.

Contact Masterly Tech Group for a Free Consultation

If you are exploring how to become a financial advisor or looking to grow an existing advisory business, we are here to help. Masterly Tech Group supports advisors with SEO-driven lead generation and operational support strategies designed for long-term growth. Our team is ready to answer questions and help you build systems that attract and support clients effectively.

Call (888) 209-4055 to book a free consultation and explore how the right strategy and support can transform your advisory business.