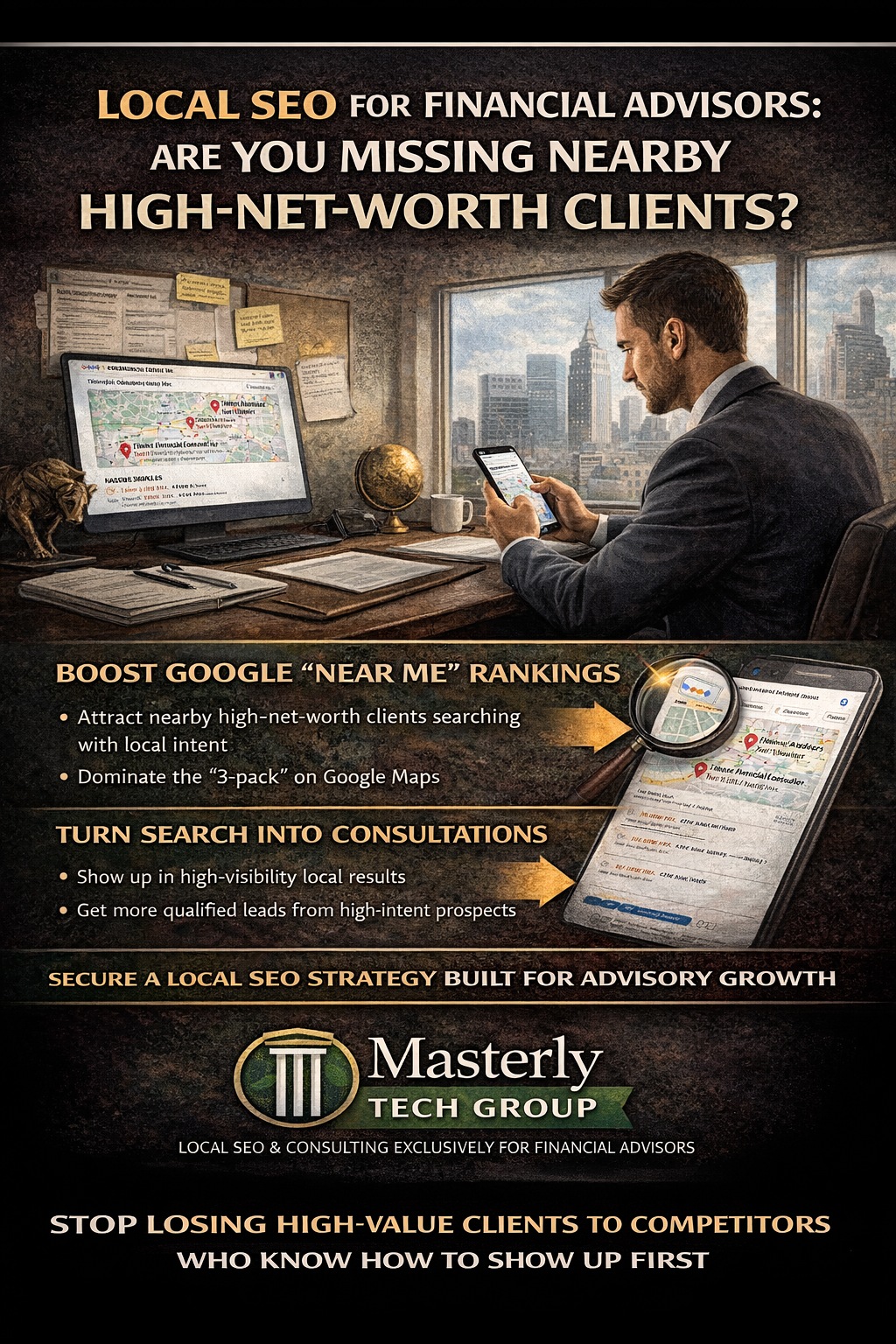

Local SEO for Financial Advisors Are You Missing Nearby High-Net-Worth Clients

If you’re a financial advisor who delivers real results, you probably already know this frustrating truth: doing great work doesn’t automatically bring great leads. You can have a strong reputation, solid credentials, and years of experience in financial planning—but still feel invisible online when local prospects search for help.

And the most painful part? Those prospects may be right down the street.

In most cities, high-net-worth individuals don’t search using complicated phrases. They search with quick, simple intent—usually on a phone—looking for someone they trust. That’s why Local SEO is such a powerful advantage for financial advisors who want to consistently attract nearby clients, not just random traffic.

At Masterly Tech Group, we help financial advisors build local visibility, improve Google Business Profile performance, and turn geo-targeted searches into booked consultations. If you suspect you’re missing local demand, you’re not imagining it—you’re likely losing opportunities to competitors who simply show up first.

The Hidden Local Market Most Advisors Don’t See

Local search is where buying intent lives. People searching for financial help usually have money, urgency, or both.

They’re not casually browsing. They’re trying to decide who to call.

When your business doesn’t appear in the top local results, you miss a steady stream of nearby prospects who are ready to take action.

Why “Near Me” Searches Can Be High-Net-Worth Searches

High-income and high-net-worth clients often value convenience and trust signals. They want expertise, but they also want someone local who feels established.

That’s why “near me” searches often convert incredibly well. The user is already mentally ready to pick someone.

If you aren’t ranking, your competitors are getting those phone calls.

What People Really Type Into Google

Most financial advisors imagine prospects search like this:

“Comprehensive retirement income strategy expert.”

In reality, people type:

“best financial advisors near me”

That phrase is simple, high-intent, and extremely competitive. It’s also one of the clearest signals that your Local SEO strategy needs to be built intentionally.

Local SEO Isn’t Optional for Financial Advisors Anymore

Local SEO is no longer a “nice extra.” It’s part of how modern advisory businesses get discovered.

Even referral-based firms get looked up online. Most people check reviews, location credibility, and basic presence before they trust you with serious money.

If your local visibility is weak, you may lose people who were already planning to hire you.

The Difference Between Ranking Nationally and Ranking Locally

National SEO is about content reach. Local SEO is about proximity, trust signals, and relevance.

Local rankings depend heavily on what Google believes about your business location and authority in that area. That means strong marketing alone isn’t enough.

Your local footprint must be clean, consistent, and optimized.

Google’s Local Algorithm Cares About Three Things

Google typically evaluates local rankings using:

- Relevance

- Distance

- Prominence

That means you can “do everything right” and still lose rankings if your signals are unclear. It’s not about having the prettiest website.

It’s about being the most trusted and most accurate match for local intent.

Why Financial Advisors Often Lose Local Rankings Without Realizing It

Most financial advisors don’t intentionally “ignore” local SEO. They just don’t realize how technical it is.

Even small issues can cause rankings to drop. Examples include category mistakes, inconsistent listings, or a weak review strategy.

Local SEO rewards clean structure and punishes confusion.

Your Google Business Profile Is Your First Impression

Your Google Business Profile is often the first thing a prospect sees. Before they read your website or your bio, they see your local listing.

That listing influences whether people trust you enough to click or call. It’s not just a “map pin”—it’s your credibility snapshot.

For financial advisors, trust is everything.

The Most Common Google Business Profile Mistakes

Small errors can create big problems. Common mistakes include:

- Wrong primary category

- Missing services

- No photos or outdated images

- No consistent posting

- Weak descriptions with no geo-targeting

If your listing is incomplete, Google assumes you’re less relevant. And prospects assume you’re less established.

Category Selection Can Make or Break Your Local Visibility

Your primary category affects what keywords you rank for. Many firms choose a vague or incorrect category and wonder why they don’t appear.

When you align categories properly, your ranking potential increases. This is one of the fastest wins that many businesses overlook.

It’s a foundational local SEO move.

Reviews Are a Local Ranking Asset, Not Just Social Proof

Reviews influence conversions, but they also influence Google’s perception of prominence. More high-quality reviews and consistent activity helps you stand out.

It’s not about buying reviews or forcing clients into awkward asks. It’s about building a natural review process.

A strong review profile also protects you against competitors trying to “outshine” you unfairly.

Why High-Net-Worth Clients Still Read Reviews

Wealthy clients don’t ignore reviews. They use them as a filter.

They may not trust “marketing,” but they trust patterns. If your reviews show clarity, professionalism, and outcomes, it builds confidence fast.

Reviews help confirm a safe decision.

Local Content Helps You Own Your City Online

To rank locally, your content must reflect location relevance. Not spammy repetition—but real, natural language that ties your expertise to your area.

Local content helps Google connect your firm with specific neighborhoods, cities, and communities. It also helps prospects feel understood.

People don’t just buy expertise. They buy familiarity.

Geo-Targeting That Actually Works (Without Keyword Stuffing)

Geo-targeting is about making your services clearly relevant to your area. The wrong approach is stuffing city names everywhere.

The right approach is building naturally localized pages and service sections that match local intent.

Google rewards helpful clarity, not forced repetition.

Location Pages Should Feel Like They Were Written for Real People

A good location page shouldn’t feel like a template. It should feel like you actually know the local client mindset.

That means referencing what clients care about, what they worry about, and what they want to achieve. It should also match how people speak in real life.

Human tone converts better—and it ranks better too.

Why Your Website Might Be Blocking Your Local Growth

Even if your site looks great, it might not be built for local conversion or local rankings.

Slow load times, weak headings, unclear structure, and missing location signals all hurt. Your website should guide people toward a next step.

A site that looks good but doesn’t generate leads is just digital decoration.

Your Service Pages Must Match Search Intent

Local prospects search for solutions, not buzzwords.

Service pages should clearly explain what you do, who you help, and what the process looks like. Your site must answer questions quickly.

This is how you attract serious clients who value efficiency.

Financial Planning Keywords That Convert Locally

Local prospects look for services they recognize, such as:

- Retirement planning

- Investment management

- Tax-smart strategies

- Estate coordination support

- Business financial planning

If your website doesn’t clearly connect these services to local intent, you lose visibility.

You don’t need more complexity—you need more clarity.

“Financial Advisors” Isn’t One Market—It’s Many

Not all financial advisors serve the same clients. Some are built for executives. Some for business owners. Some for retirees. Some for young professionals.

Local SEO works best when your messaging targets your real audience.

The more specific your positioning, the more qualified your leads.

Why “Nearby” Clients Often Become Your Best Clients

Nearby clients are easier to retain, easier to refer, and easier to build trust with. Even if you also serve people virtually, local connections create stronger client relationships.

Many firms scale faster when they dominate their local market first.

Local authority creates long-term stability.

The Role of Google Maps in Client Acquisition

Google Maps rankings often drive more calls than organic rankings.

When someone searches locally, the map pack usually appears first. That means your Google Business Profile is competing in a high-visibility zone.

If you’re not in that top group, you’re missing high-intent traffic.

What “Local Authority” Looks Like for Advisors

Local authority looks like:

- Strong review velocity

- Consistent listings and citations

- Local content relevance

- Accurate category alignment

- Clear website service structure

It’s not about tricks. It’s about signals that Google can trust.

And trust leads to visibility.

Citations: The Unseen Factor That Impacts Rankings

Citations are directory mentions of your business name, address, and phone number.

When citations are inconsistent, Google loses confidence. When they’re clean, you gain ranking strength.

This is a technical detail that creates real-world results.

Why Consistency Matters More Than Most People Think

Google doesn’t “assume” your information is correct. It verifies.

If your firm appears with multiple phone numbers or small address variations across the web, it weakens your prominence.

Consistency supports stability, and stability supports growth.

The Local SEO Mistake That Costs Advisors the Most Money

The biggest mistake isn’t lack of marketing effort. It’s lack of structure.

Posting occasionally isn’t a strategy. Running ads without fixing local credibility isn’t a strategy.

Local SEO is compounding—when you build it correctly, it keeps producing results month after month.

The “Busy Advisor” Problem: Great at Finance, No Time for Marketing

Most financial professionals are overloaded. You’re managing portfolios, client meetings, compliance, and constant communication.

Local SEO requires attention, consistency, and ongoing refinements. And that’s difficult when you’re already at capacity.

That’s why systems—and support—matter.

Why Advisory Firms Need Operational Support to Scale

If you want growth, you can’t do everything yourself forever.

Successful advisory practice owners build support systems for:

- Lead handling

- Scheduling

- Client follow ups

- Admin coordination

- Marketing execution

Without support, you hit a ceiling.

Where Virtual Assistants Fit Into the Growth Equation

The right virtual assistant can keep your business running smoothly while you stay focused on revenue-producing work.

This is especially true when local SEO starts working and you begin receiving more inbound leads. Someone has to handle messages, scheduling, and follow-up.

That’s where virtual assistants can become a real leverage tool.

Virtual Assistant Services That Help Advisors Capture More Local Leads

When local SEO begins producing calls and form submissions, speed matters.

A fast response can be the difference between winning and losing a high-net-worth prospect.

That’s why virtual assistant services are often a smart layer of support for advisors who want consistent conversion from their local traffic.

What a Financial Advisor Virtual Assistant Can Do Day-to-Day

A financial advisor virtual assistant can support your workflow behind the scenes.

They can manage the pieces that are time consuming but critical to growth. That includes admin coordination, client scheduling, and follow-up tracking.

When done correctly, it protects your calendar and your focus.

Specialized Support Through Financial Virtual Assistant Help

A financial virtual assistant can be trained to understand the unique workflow of advisory firms.

This includes tasks related to onboarding, scheduling, and general back-office support. While they may not provide regulated advice, they can support your team’s efficiency.

They help reduce chaos—and high-net-worth clients notice smooth operations.

Why Financial Advisor Virtual Assistants Help Improve Client Experience

A strong client experience isn’t just about investment performance.

It’s also about responsiveness, organization, and professional systems. Financial advisor virtual assistants can help maintain that experience consistently.

High-net-worth clients expect a polished process. They pay attention to details.

Client Onboarding Is a Local SEO Conversion Moment

Local SEO gets the client to you.

Client onboarding determines whether they stay.

When onboarding is messy, prospects lose confidence quickly—even if you’re technically the best advisor in town.

A clear onboarding process builds momentum and trust.

The Onboarding Process Needs Speed and Structure

Your onboarding process should reduce friction. That means fewer delays, fewer missed emails, and fewer confusing handoffs.

If prospects wait too long to hear back, they often keep searching. They don’t usually announce it—they just disappear.

Speed creates a positive experience.

Virtual Assistants Support Fast Response Times

When you have more leads than time, you need help.

A trained virtual assistant can respond quickly, confirm next steps, and keep your pipeline warm without sacrificing professionalism.

It’s one of the simplest ways to prevent missed opportunities.

Delegate Tasks That Drain Your Energy

Advisors shouldn’t spend prime hours on low-value work.

If you can delegate tasks like scheduling, follow ups, and basic coordination, you preserve the time you need for clients and strategy.

That’s how you scale without burning out.

Administrative Tasks That Quietly Slow Your Growth

Many firms get stuck doing the same repetitive administrative tasks every day.

Those tasks feel small, but they add up quickly.

If you want growth, you must reduce those bottlenecks.

Operational Tasks That Can Be Outsourced Safely

A properly trained assistant can take on many operational tasks that do not require licensed financial advice.

This keeps your back office organized without risking compliance issues.

You stay focused on high-value conversations.

Back Office Support Improves Consistency

A well-managed back office supports faster communication, cleaner records, and smoother workflow.

When your systems feel organized, prospects feel more confident.

Local leads are more likely to convert when the process feels professional.

Client Communication Is Where Trust Is Won or Lost

High-net-worth prospects pay attention to response quality.

Strong client communication is polite, clear, and fast. Weak communication feels vague and slow.

That difference impacts whether people trust you with serious money.

Handling Phone Calls Without Missing Leads

If you’re in meetings all day, unanswered phone calls can become lost revenue.

Local SEO increases inbound contact. You need a system to respond quickly, even when you’re busy.

This is where a dedicated assistant becomes valuable.

Scheduling Appointments Should Be Seamless

Local prospects want a simple next step.

If scheduling appointments becomes a back-and-forth email chain, conversion drops.

Streamlined scheduling reduces resistance and increases bookings.

Scheduling Meetings Efficiently Builds Momentum

One of the easiest ways to lose a lead is to delay scheduling.

When you can confirm and scheduling meetings quickly, clients feel progress. They feel supported.

That momentum helps close high-value opportunities.

Why “Schedule Meetings” Is a Marketing Strategy Too

Most firms treat scheduling like admin work.

But the ability to schedule meetings smoothly is part of your brand. It signals professionalism, preparedness, and quality.

Local SEO gets attention. Systems earn trust.

Client Files Must Be Protected and Organized

When you’re growing, organization becomes critical.

Managing client files and keeping everything accessible supports better service and fewer mistakes.

High-value clients expect clean operations.

Client Data Needs Accuracy and Care

Even minor errors with client data can create a bad impression.

Your systems should ensure consistent updates, secure storage, and clean workflows.

Organization reduces risk and improves trust.

Data Entry Helps Keep the Machine Running

Someone needs to keep records updated.

Consistent data entry helps maintain accurate tracking for follow ups, onboarding, and service quality.

It’s not glamorous—but it drives retention.

The Role of Financial Data and Reports

Your internal workflow relies on accurate financial data.

Supporting documentation and tracking can help advisors stay organized and proactive.

A strong team helps you stay ahead of client expectations.

Preparing Reports Without Burning Advisor Time

Advisors often spend too much time preparing reports that could be systematized.

This is where staffing and structured workflows matter.

A virtual assistant can support document preparation and coordination.

Financial Reports Support Better Communication

Clear financial reports help clients understand what’s happening and why.

They also reduce confusion and unnecessary calls.

Better reporting supports long-term retention.

When Data Analysis Supports Better Strategy

Even light data analysis can help your business understand lead sources and client patterns.

Local SEO performance can be tracked, refined, and improved.

The goal is repeatable growth, not guesswork.

Financial Software and Advisor Tools Must Work Together

Many firms rely on multiple tools.

Using financial software effectively requires clean workflows and consistent usage.

When systems don’t connect, mistakes happen and time is lost.

Portfolio Accounting Software Needs Support Systems

Even one tool like portfolio accounting software can require ongoing admin support.

Advisors shouldn’t be stuck troubleshooting or updating records all day.

Support keeps operations smooth.

Existing Systems Can Be Improved Without a Full Overhaul

Most firms already have tools in place.

Your existing systems don’t have to be perfect, but they must be consistent.

Small improvements often create big gains.

Handling Client Agreements Smoothly Builds Trust

When someone is ready to move forward, your process must feel clean.

That includes handling client agreements efficiently.

The smoother it is, the more confident clients feel.

Client Agreements Should Never Feel Confusing

Good systems make client agreements easy to understand and easy to execute.

Confusion creates hesitation. Clarity creates commitment.

This is part of client experience design.

Assistant Services for Financial Firms Are Becoming Standard

Many advisory businesses now invest in assistant services for financial growth.

This isn’t luxury support anymore—it’s competitive necessity.

Clients expect speed, professionalism, and organization.

Services for Financial Advisors Must Be Built for Compliance

Not all support is equal.

The best services for financial advisors respect confidentiality, workflow standards, and communication expectations.

Support must strengthen trust, not create risk.

Virtual Assistant Companies vs. Dedicated Support

Some virtual assistant companies offer random generalists.

But financial advisors often need specialized workflows and consistency.

The difference is support quality and stability.

Dedicated Assistant Support Creates Real Momentum

A dedicated assistant learns your business and improves with time.

That creates fewer mistakes, better follow-ups, and more consistent client experiences.

This kind of support compounds—just like good investing.

Personalized Support Helps You Stay Human at Scale

High-net-worth clients want to feel like they matter.

Personalized support helps ensure your communication and processes don’t feel robotic.

Systems should help you feel more present, not less.

In House Staff Isn’t Always the Best First Step

Some firms think hiring in house staff is the only option.

But that comes with overhead, payroll complexity, and long-term commitments.

Virtual assistants can be a flexible, scalable alternative.

Hire a Virtual Assistant to Protect Your Advisor Time

If your schedule is full, but growth is still the goal, you may need to hire a virtual assistant.

The goal isn’t to replace you—it’s to protect your highest-value work.

That’s how advisory firms scale without losing quality.

Pre Vetted Talent Reduces Hiring Stress

Many firms fear delegating because training feels exhausting.

Using pre vetted support helps reduce risk and speed up results.

Better staffing makes you more confident in the process.

Highly Qualified Support Makes Local SEO Worth It

If local SEO starts working and you can’t keep up, it becomes frustrating.

Highly qualified assistant support helps your business capture the opportunity.

Traffic is only valuable if it turns into booked calls.

Working Across Time Zones Can Increase Responsiveness

Some firms benefit from support operating across time zones.

It can allow faster follow-up windows and more coverage during busy schedules.

Speed improves conversion.

Hourly Rate vs. Real ROI

A low hourly rate doesn’t matter if the work is inconsistent.

ROI comes from reliable execution, communication, and professional outcomes.

Good support pays for itself through saved time and captured leads.

Regular Check Ins Keep Performance Strong

Even strong assistants perform better with structure.

Regular check ins help align expectations, improve workflows, and ensure consistency.

The goal is ongoing improvement, not constant fixes.

The VA Handles the Tasks You Can’t Keep Up With

A great VA doesn’t just “help a little.” They create real operational relief.

When the va handles scheduling, follow ups, and coordination, the advisor regains breathing room.

That breathing room creates growth capacity.

Follow Ups Are Where Most Firms Lose Revenue

Most advisors don’t lose leads because they’re unqualified.

They lose leads because of slow follow ups.

A structured follow-up system improves conversion and reduces dropped opportunities.

Follow Up Systems Turn Interest Into Appointments

A consistent follow up process keeps prospects engaged.

It also helps people who were interested but distracted.

Many high-value leads convert on the second or third touch.

Support Financial Advisors by Protecting Focus Time

The best systems support financial advisors by protecting the advisor’s calendar.

The more time you spend with clients and strategy, the stronger your results.

Local SEO creates opportunity. Support systems capture it.

Your Advisory Practice Should Feel Like a Machine (In a Good Way)

A great advisory practice runs smoothly.

Clients feel cared for. Requests are handled quickly. Scheduling is effortless.

Operational excellence is a competitive advantage.

Your Team Is Part of Your Brand

Your team isn’t just internal.

Prospects feel the quality of your business through communication and responsiveness.

The team experience becomes the client experience.

Ongoing Support Is What Makes Growth Sustainable

Growth isn’t just marketing.

It’s capacity, systems, and ongoing support that prevents overwhelm.

This is what separates firms that scale from firms that stall.

A Solo Advisor Can Still Compete Locally

A solo advisor can dominate a local market with the right strategy.

Local SEO and strong support systems can help you compete against larger firms.

You don’t need a massive staff—just smart structure.

Business Growth Happens When Systems Replace Chaos

Your business grows when your process becomes predictable.

Local SEO increases demand. Support increases capacity.

That combination is a real growth engine.

Growth Requires Focus, Not More Stress

Most advisors want growth, but not burnout.

That’s why your focus should be on high-value work and relationship building.

Let systems and support handle the rest.

A Game Changer for Local Visibility and Lead Quality

When you rank locally, inbound lead quality improves.

When your process is smooth, close rates improve.

That combination can become a game changer for advisors who want serious growth without chaos.

Why Masterly Tech Group Helps Financial Advisors Win Locally

At Masterly Tech Group, we build Local SEO strategies designed specifically for advisors who want nearby clients—not vanity traffic.

We optimize your Google Business Profile, improve local rankings, and build geo-targeted visibility that connects you with high-intent searches. We also help you build operational systems that reduce friction once leads start coming in.

This is not generic marketing. It’s practical growth support built for real advisory businesses.

Financial Virtual Assistants Who Understand Advisor Workflows

Financial virtual assistants can be a strong fit for advisory firms that want reliable help without adding full-time overhead. Unlike general support, financial virtual assistants are familiar with the rhythm of an advisory practice and can support both front-facing coordination and back-office follow-through. When you need consistent execution, having help that understands what matters in wealth management environments can make daily operations feel calmer and more controlled.

We Offer Virtual Assistant Services Built for Financial Firms

At Masterly Tech Group, we offer virtual assistant services designed around real advisory operations, not generic admin templates. Our goal is to match you with support that fits how your firm works, so the work actually gets done the right way and on time. This approach helps protect your calendar, improve responsiveness, and support growth without adding chaos.

Support for Financial Planners Focused on Client Experience

Many financial planners want to spend more time in planning conversations and less time buried in inboxes, follow-ups, and scheduling. The right support helps create a smoother client experience, especially when local SEO starts driving more inbound interest. With organized processes in place, planners can stay focused on strategy while clients feel taken care of.

Specialized Tasks That Keep Your Practice Moving

When your firm is growing, small bottlenecks multiply, and that’s where specialized tasks matter. This can include keeping onboarding moving, preparing internal documentation, organizing communications, and coordinating deadlines across your team. Having help that can handle these tasks consistently protects quality while reducing last-minute stress.

Extensive Knowledge That Reduces Training Time

A support team with extensive knowledge of professional service workflows can reduce the time it takes to get real traction. Instead of starting from scratch, you can plug support into your existing systems and build momentum faster. That means fewer mistakes, fewer repeated explanations, and better reliability for your practice.

Administrative Support That Protects Your Schedule

Strong administrative support is one of the simplest ways to protect your time and improve the client experience. When scheduling, confirmations, documentation, and follow-ups are handled consistently, your day feels more predictable. That consistency becomes even more valuable when new leads start coming in from local search.

Support That Matches Your Business Needs

No two advisory firms run exactly the same, which is why aligning support to your business needs matters. Some firms need lead response and scheduling coverage, while others need operational follow-through and pipeline organization. When support is tailored correctly, it becomes an asset—not another system to manage.

Expense Tracking That Keeps Operations Clean

Even when you’re not focused on accounting, expense tracking helps keep your business organized and decisions clear. A reliable assistant can help maintain records, categorize expenses, and keep routine updates flowing so you’re not scrambling later. Clean tracking supports smarter planning and fewer operational surprises.

Social Media Posts That Stay Consistent Without Draining Time

Consistent social media posts help reinforce credibility, especially when prospects look you up after finding you locally. The key is keeping content professional and aligned with your voice without requiring hours from your calendar. With the right support, you can stay visible and consistent while still prioritizing client work.

Handling Specific Tasks Without Losing Focus

Most advisors don’t need “more help” in general—they need help with specific tasks that keep piling up. Whether it’s inbox triage, scheduling coordination, document requests, or follow-up organization, taking these items off your plate restores focus quickly. That regained focus is what creates room for growth.

A Deep Understanding of How Advisor Firms Operate

Support works best when the assistant has a deep understanding of how advisory relationships function and why responsiveness matters. That includes professionalism in communication, attention to detail, and respect for client expectations. When support is aligned with your standards, clients feel the difference.

A New Employee Alternative Without the Overhead

Hiring a new employee can be expensive and time-consuming, especially if you’re not ready for long-term payroll commitments. Virtual support can provide flexibility while still delivering consistent execution. This gives you space to scale smartly and add permanent roles only when the timing is right.

Supporting New Clients With a Smoother First Impression

When new clients come in from local search, the first few interactions set the tone for trust. Fast responses, clean scheduling, and organized onboarding build confidence quickly. The right support helps ensure your first impression matches the high quality of your financial planning work.

Industry Experts Who Help You Scale With Confidence

Working with industry experts can help you avoid trial-and-error when building systems for growth. Instead of guessing what works, you can implement proven workflows that support lead conversion and client retention. That guidance matters most when your inbound volume starts increasing.

Well Versed Support That Fits Professional Standards

You want support that is well versed in professional communication, confidentiality expectations, and consistent follow-through. That’s especially important in financial environments where trust is the foundation of everything. Reliable support helps your firm feel polished, responsive, and stable.

Support Built Around Your Specific Needs

The best results come when you match support to your specific needs instead of forcing a one-size-fits-all role. Whether you need lead response coverage, schedule management, onboarding coordination, or ongoing admin execution, the right fit makes everything easier. When support is tailored, it becomes a real growth lever rather than just “extra help.

Contact Masterly Tech Group for a Free Consultation

If you’ve ever wondered why competitors keep showing up ahead of you—even when you know you’re the better choice—Local SEO may be the missing piece. Nearby prospects are searching every day, and the ones with serious assets often move quickly once they find someone they trust.

At Masterly Tech Group, we help financial advisors strengthen local visibility, optimize geo-targeting, and turn local search traffic into real appointments. If you want to start attracting people searching best financial advisors near me, we’ll help you build a strategy that feels professional, natural, and built for long-term growth.

Call (888) 209-4055 to book your free consultation. Let’s talk about what’s holding your local rankings back, how to fix it, and how we can help you capture the high-value clients who are already nearby.